Congratulations! You have decided to take the leap and buy a house in the Netherlands. The land of windmills, tulips and Gouda cheese offers a fantastic lifestyle, and having a piece of that sounds amazing. But navigating the Dutch real estate market can feel like deciphering a Rembrandt masterpiece: a bit daunting at first glance.

The topic of mortgages is very extensive so in this post I try to explain in a quick way the most common doubts about mortgages in Holland, if your plan is to stay for several years in the country it can be interesting to buy a house. Even with interest rates these days.

- Can I buy a house if I do not have Dutch nationality?

- Mortgage/Financing

- Basic requirements

- How much can you spend on a house?

- Acquisition costs of an existing property

- Costs of acquiring a new home

- What costs are tax deductible?

- Mortgage rates in the Netherlands

- Annuïteitenhypotheek (fixed mortgage)

- Lineaire Hypotheek (Linear Hypotheek)

- Interest rates

- Where can I compare current interest rates?

Can I buy a house if I do not have Dutch nationality?

Yes, there are no restrictions for foreigners to buy property in the Netherlands. However, to obtain a mortgage, you must live and be registered in the country. If you are from the EU, EEA or Switzerland, you do not need a visa to live or work in the Netherlands, but you will still need a residence permit and a national identification number (BSN).

In case you have a residence permit it must be for a non-temporary purpose, you can see this in the IND website

Mortgage/Financing

Most people do not buy their home outright. Instead, they take out a mortgage: a bank loan against the property. Mortgage interest rates are not as low as they were a couple of years ago, but they are still low compared to Latin America. Also in the Netherlands it is possible to take out a mortgage for 100% of the value of the house.

Basic requirements

To apply for a mortgage it is necessary to prove income through a permanent employment contract and also a statement from your employer ( werkgeversverklaring ) detailing your contract and salary.

If you have a temporary contract or work for a Dutch university as a doctoral candidate or researcher, you must also provide a statement from the employer or institution confirming that your position is current or will be permanent.

How much can you spend on a house?

First things first, let’s talk about money. Calculate a comfortable budget for the house itself, taking into account not only the purchase price, but also ongoing costs such as taxes and maintenance. Don’t forget to take into account the additional costs of buying the house (kosten koper) which for existing houses (bestaande woning) are about 6% and for new houses (nieuwbouw) 2% of the purchase price. Here is a breakdown of the main expenses:

Acquisition costs of an existing property

- Property tax (Overdrachtsbelasting): This is a government tax of 2% on the purchase price, unless you are a first-time buyer under 35 years of age buying a property for less than €510,000 (as of January 1, 2024). In that case, you get a tax benefit.

- Notary fees (Notariskosten): The notary will take care of the legal aspects of the purchase. Unlike in countries such as Mexico, the notary charges a fixed fee and not a percentage of the value of the property.

- Cadastral taxes (Kadasterkosten)

- Closing costs (consulting and mediation)

- Appraisal fees (Taxatiekosten) are the fees paid to the appraiser for appraising the property, determining its market value. This is crucial for the negotiation of the purchase price.

- Architectural inspection (Bouwkundige Keuring): An aankoopkeuring involves a thorough inspection of a property by a construction specialist, who issues a detailed bouwkundig report on its condition.

- NHG(Nationale Hypotheek Garantie) application fees: if applicable. If you want to know more about what is NHG check out the article What is NHG (Nationale Hypotheek Garantie)?

Costs of acquiring a new home

- VAT (BTW)

- Loss of interest during construction

- Interest in land

- Utility connection

- Agency fees (Makelaarscourtage)

- Architects’ fees

Unlike other countries, the Netherlands does not offer mortgage pre-approvals. In fact it is very common to make an offer on a house and once it is accepted, you can apply for a mortgage based on the agreed purchase price. But the truth is that it is better to know in advance what is the maximum mortgage you can get.

If you want to know how much is your maximum mortgage you can check it at Hypotheek-Rentetarieven.nl. By clicking on the banner below you will be redirected to them and with this you help the blog and future articles.

What costs are tax deductible?

There are some expenses that you can deduct only once in the tax year of the home purchase. With some exceptions, these expenses are also deductible when changing the mortgage to another mortgage provider.

- Mortgage deed expenses, both notarial and land registry (Hypotheekakte, notaris, Kadaster).

- Appraisal fees (only for obtaining a loan)Taxatiekosten

- Closing commission and brokerage fees (Afsluitprovisie en bemiddelingskosten)

- NHG application fees

- Penalty interest paid or transfer fees (Betaalde boeterente of oversluitkosten)

Did you know that not all notaries charge the same? This is why it is good to compare different notaries where you live, and there is no better place to do this than DeGoedkoopsteNotaris.nl. For 20 years, DeGoedkoopsteNotaris.nl has been the best place to compare notaries. Every year, more than 650,000 people compare notaries on this website. Here you can compare prices, ratings and locations of all notaries. You can directly contract the cheapest or the best option online and get a discount! In addition, DeGoedkoopsteNotaris.nl offers a free service to request up to 3 quotes.

If you want more information about them you can click on the banner below, this helps the blog and future articles.

Mortgage rates in the Netherlands

Mortgages in the Netherlands have terms of 30 years and the two most common types in the Netherlands are:

- Annuïteitenhypotheek (fixed mortgage)

- Lineaire Hypotheek (Linear Hypotheek)

Annuïteitenhypotheek (fixed mortgage)

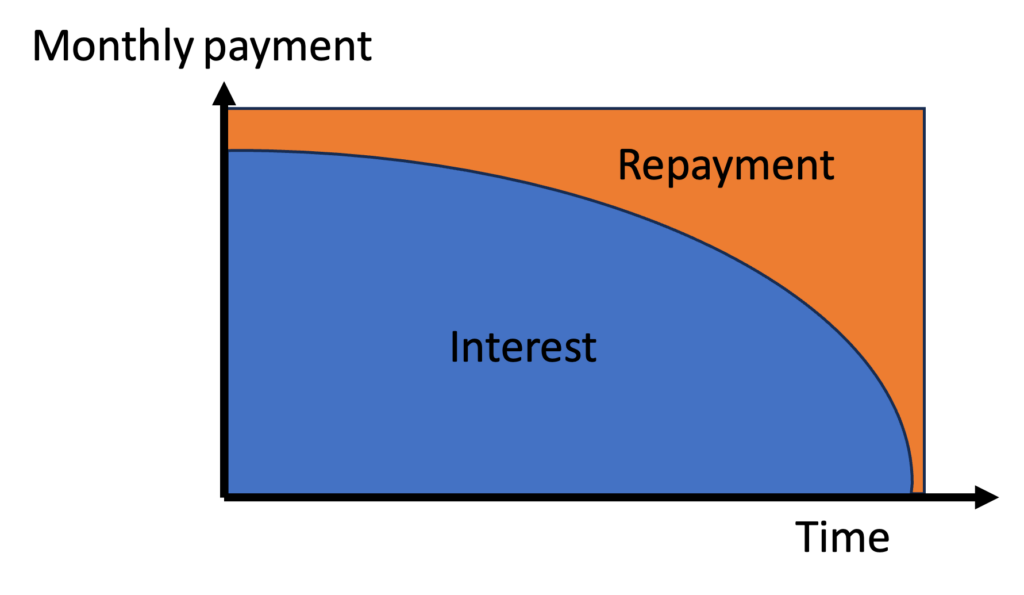

Most first-time buyers opt for an Annuïteitenhypotheek (fixed mortgage) because of its low initial monthly payments. This is the one I chose because the gross monthly payment is the same throughout the life of the mortgage.

As you can see in the image below the payment is the same for the entire duration of the mortgage, the payment is composed of two things: interest + principal payment (amortization). At the beginning the interest payment is higher since you pay interest on the money you owe the bank, as time goes by you owe less money and therefore pay less interest and more on the principal. The image is exaggerated for illustrative purposes.

The advantages and disadvantages are listed below:

Advantages:

- Full right to mortgage interest deduction (hypotheekrenteaftrek).

- Low monthly payments at the beginning of the mortgage.

- The gross monthly payments remain constant, and the mortgage is paid in full at the end of the term.

- You are eligible for NHG and the lenders do not charge you an interest surcharge.

Disadvantages:

- Net monthly payments increase over time due to the decrease in the interest deduction (hypotheekrenteaftrek).

- Amortization is slower than with a straight-line mortgage, resulting in higher total interest payments over the term.

* The latter is only true as long as you do not make voluntary contributions to capital.

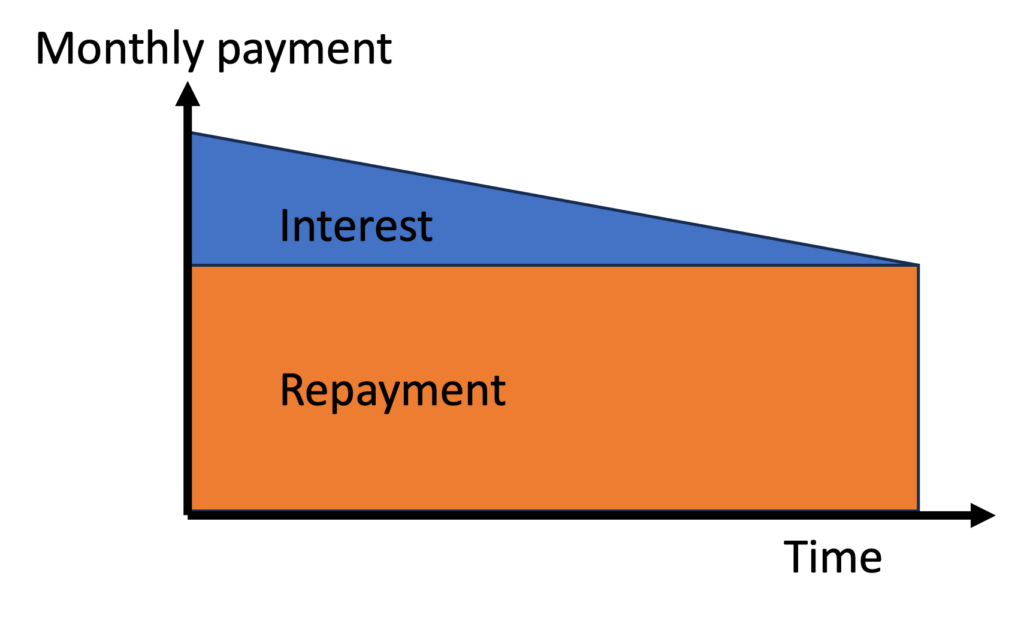

Lineaire Hypotheek (Linear Hypotheek)

The straight-line mortgage involves constant principal payments for the entire term of the loan. As shown in the image below, the principal payment is the same for the entire term, and the interest rate decreases as time goes by. This results in a higher gross payment at the beginning of the mortgage payment than at the end.

Here are some key considerations:

Advantages:

- Full right to mortgage interest deduction (hypotheekrenteaftrek).

- Monthly payments decrease over time.

- The mortgage is paid in full at the end of the term, and you pay less interest in total than with other mortgages.

- You are eligible for NHG and the lenders do not charge you an interest surcharge.

Disadvantages:

- Down payments can be relatively high.

- The interest deduction is lower than with a fixed mortgage (Annuïteitenhypotheek).

Interest rates

When you apply for a mortgage, you have the option to lock in the interest rate for a specified period, which generally ranges from 1 to 30 years. During this period, your interest rate remains constant, which gives you financial stability and predictability in your monthly payments. The interest will be higher when you fix it for longer periods of time, so the fixed interest for 20 years will be higher than the fixed interest for 10 years.

Importance of Choosing the Right Period

The choice of the interest rate fixation period depends on several important factors, including:

- Your Financial Goals: Are you looking to pay off your mortgage quickly or do you prefer to keep your monthly payments low?

- Market Outlook: Are interest rates expected to rise or fall in the near future?

- Future Plans: Do you plan to stay in your home for the long term or do you intend to move in a few years?

Common Fixing Period Options

Mortgage interest rates per lock-in period can vary from short to long periods. Here are some common options:

- Short Periods (1-5 years): Offer lower interest rates initially, but may increase after the maturity of the period.

- Long Terms (over 5 years): Provide long-term stability with fixed interest rates, but may have higher initial rates.

How to Choose the Right Period?

The choice of the appropriate fixing period depends on your financial situation and your long-term objectives. Here are some key considerations:

- If you prefer low initial monthly payments and are willing to assume the risk of a future increase in interest rates, a short term may be right for you.

- On the other hand, if you value stability and predictability in your monthly payments and plan to stay in your home for the long term, a longer term may be more appropriate.

End of the Fixing Period

At the end of your interest rate lock-in period, you will have the opportunity to review and possibly change your mortgage. You may consider:

- Negotiate with your bank to obtain a lower interest rate.

- Transfer your mortgage to another lender that offers better terms.

- Re-evaluate your financial needs and adjust your mortgage accordingly.

Where can I compare current interest rates?

There are websites that compare interest rates from many mortgage providers. One such site is Hypotheek-Rentetarieven.nl. With them you can compare current interest rates with 34 providers in the Netherlands. They also help you transfer your mortgage to another lender. By clicking on the banner below you will be redirected to them and with this you help the blog and future articles.