Cryptocurrencies have been all the rage in recent months because of the returns they can offer. As in this blog I like to be more conservative in this post I show you how to earn 6% interest in Bitvavo in a relatively safe way.

What is Bitvavo?

Bitvavo is a cryptocurrency exchange, the largest in the Netherlands, you can add balance to your account via IDEAL or bank transfer for free. It has an app for Android and IOS. It is registered with De Nederlandsche Bank (DNB).

Bitvavo offers rewards for having your cryptocurrencies with them. And one of the most attractive is the rewards for holding cryptocurrencies at 1-1 parity with the dollar. These cryptocurrencies are known as stablecoins. The stablecoins that can be purchased on Bitvavo are: USDC, USDT, Dai

USDC- This coin is the stablecoin of the Coinbase exchange. Each USDC is backed by one physical dollar deposited in financial institutions regulated by the U.S. government. Runs on the Ethereum network

Dai- This coin belongs to the MakerDAO project, a decentralized autonomous organization (DAO). This is not 100% equivalent to 1 dollar but it is very close. It is backed by deposits in other cryptocurrencies made on the MakerDAO platform.

USDT- Also known as Tether, is a cryptocurrency issued by a company called Tether Limited. Its parity is 1 to 1 with the dollar. In theory each Tether is backed by one dollar in a reserve but the company has been embroiled in controversy. Apparently each Tether is only backed by $0.74 in cash and cash equivalents.

In my opinion USDC and DAI are less risky than Tether.

How to buy stablecoins on Bitvavo?

Just download the Bitvavo app or register on their website and deposit money into your account via IDeal. If you don’t have a Bitvavo account yet, you can use my referral link and you won’t be charged any commission for the first week.

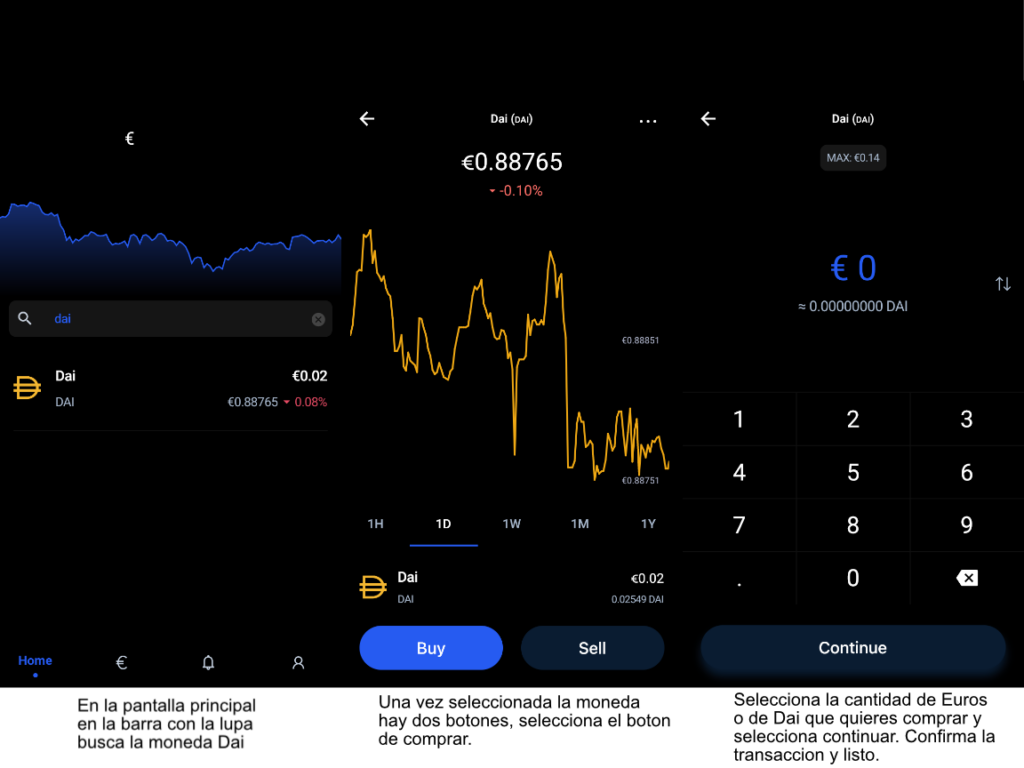

Once you have money in your account, look for the coin you want to buy, click on buy and you have your stablecoin in Bitvavo. From that moment on, every Monday of the week you will be deposited your rewards in the currency you have. At the time of writing (November 2021) this reward is equivalent to 6% per annum.

What are the risks?

As with all investments, you should not invest money that you cannot afford to lose. With this in mind, there are some risks to consider when investing in this platform.

- That the dollar devalue against the euro. Being a currency with a 1-1 parity with the dollar, the money you deposit will be converted to dollars and the interest you will be paid on those dollars, if at the moment you want to change your dollars to euros the exchange rate is not so good, you may lose out, on the contrary, it may be favorable and you may gain twice: for the exchange rate and for the interest you will be paid.

- May the stablecoin disappear, there are some stablecoins that don’t have such a good reputation because of the way they make sure the currency maintains parity (e.g. USDT Tether).

- That the exchange disappears, well this risk always exists in cryptocurrency exchanges, since they are not backed by any authority and there is no one to respond in case it disappears from one day to another. But the fact that at least Bitvavo is registered with DNB gives me a little more peace of mind.

If you want to learn more about cryptocurrencies you can read the previous post on the blog How to buy Bitcoin and other cryptocurrencies?